What does the Australian supermarket chain Coles have in common with the CIA? As of last week, both are clients of Palantir Technologies, a U.S. tech company “focused on creating the world’s best user experience for working with data.”

In a three-year deal, Coles plans to deploy Palantir’s tools across more than 840 supermarkets to cut costs and “redefine how we think about our workforce.”

The tech company, named after magical seeing stones from The Lord of the Rings, offers comprehensive software that collects, organizes, and visualizes a client’s data in “one platform to rule them all.” For an intelligence agency, Palantir’s tools might help identify a terror cell through phone calls and financial transactions; in a healthcare organization, they might find ways to save money by shortening emergency department stays.

For Coles, the goal is to “optimize its workforce” by analyzing “over 10 billion rows of data, comprising each store, team member, shift and allocation across all intervals in a day, every day.”

The announcement is linked to Coles’ plan to save a billion dollars over the next four years, and follows a 2019 big data deal with Microsoft, an effort to build robotic delivery centers, and the introduction of customer-tracking cameras and other high-tech security measures.

The Palantir process

What might this Palantir-Coles collaboration look like in practice?

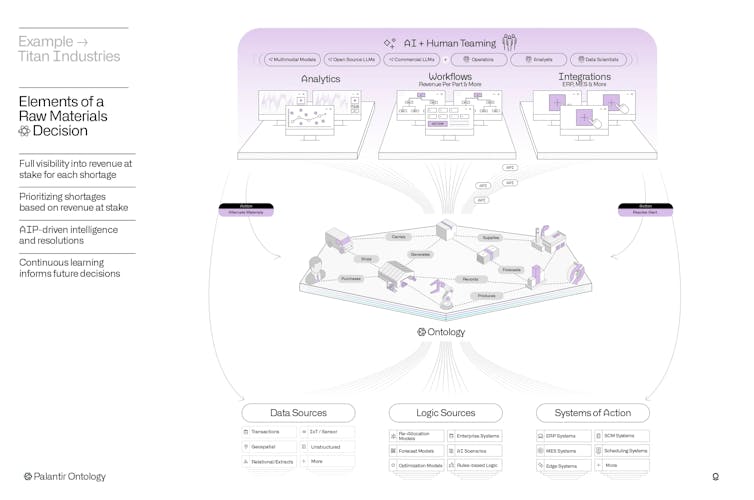

Typically, Palantir first sends out “forward-deployed engineers” to begin work with an organization’s data, which is often messy, incomplete, and fragmented. These engineers work with different branches and stakeholders to bring the data together into a single compatible whole called “The Ontology,” which contains all the information deemed relevant.

Then the data can be fed into Palantir’s platforms in this case, customizable software called Foundry and the Artificial Intelligence Platform.

The platforms let clients explore the data through dense but user-friendly interfaces populated by columns and rows, boxes and lines. The Artificial Intelligence Platform also brings ChatGPT-like language models into the mix.

Users might compare earnings between branches, flag a store that seems inefficient, or identify an upcoming period of high spending based on historic patterns.

All of this probably seems banal, or even boring. It’s certainly less overtly problematic than Palantir’s work with governments and law enforcement, which has been slammed for enabling data-driven deportation or racist policing, and seen the company described as “evil.”

However, the deal doesn’t need to be overtly malevolent to be meaningful. A technology of surveillance and control is quietly becoming infrastructure, moving from front-page news to something ticking along silently in the background. In this sense, Palantir shifts from the visible to the operational, imperceptibly but powerfully shaping the lives and livelihoods of Australian supermarket employees and shoppers.

Optimizing the Coles workforce

We can briefly sketch out three implications of the deal.

First, by inking this deal, Coles frames itself as future-forward and logistically driven. Groceries and grocery store labor become more data, just like the hedge funds, healthcare, or immigrants that other Palantir clients coordinate.

Supermarkets have been under fire over the past year for increasing profit margins through a pandemic and cost-of-living crisis and accused of underpaying workers.

The Palantir deal continues this extractive trajectory. Rather than paying workers more or passing savings onto customers, Coles has chosen to invest millions in technology that will “address workforce-related spend” as part of a larger effort to cut costs by a billion dollars over the next four years. Food (and the labor needed to grow, pack, and ship it) is transformed from a human need to an optimization problem.

A walled garden

Second, dependence. As my own research found, Palantir clients tend to enjoy the all-encompassing data and new features, but also become dependent on them. Data mounts up; new servers are needed; licensing fees are high, but must be paid.

Much like Apple or Amazon, Palantir’s services excel at creating “vendor lock-in,” a perfect walled garden that clients find hard to leave. This pattern suggests that, over the next three years, Coles will increasingly depend on Silicon Valley technology to understand and manage its own business. A company that sells a quarter of Australia’s groceries may become operationally reliant on a U.S. tech titan.

A way of seeing

Finally, vision. What Palantir sells is fundamentally a way of seeing. Its dashboards promise a God’s-eye view that can stretch across an entire organization or zoom in to granular detail to locate that “needle in the haystack” insight.

The claim is that this data-driven view is a shortcut to total knowledge, a way to map every operation, reveal every important element, and identify every inefficiency.

Yet the data inevitably excludes significant social, financial, and environmental information. The sweat of workers struggling to pack at pace, the belt-tightening of consumers struggling to make ends meet, and the struggle of farmers to survive unexpected climate impacts will go untracked.

Such details never appear on the platform — and if they’re not data, they don’t matter. Will Palantir’s data-driven myopia translate to how Coles views its workers and customers?

By placing Palantir at the heart of its operations, Coles quietly smuggles in several key assumptions: that food is a commodity to be optimized, that paying for labor is a risk rather than a responsibility, and that data can capture everything of importance. At a time of increased food insecurity, Australians should strongly question whether this is the direction one of our major grocery providers should take.

Luke Munn, Research Fellow, Digital Cultures & Societies, The University of Queensland

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Follow us on X, Facebook, or Pinterest